Join our community of traders and investors who are transforming their financial futures through expert technical analysis and proven strategies.

Candlestick patterns represent price movements and trader sentiment. Common patterns include Doji, Hammer, Engulfing, and Shooting Star, which help predict reversals and trends.

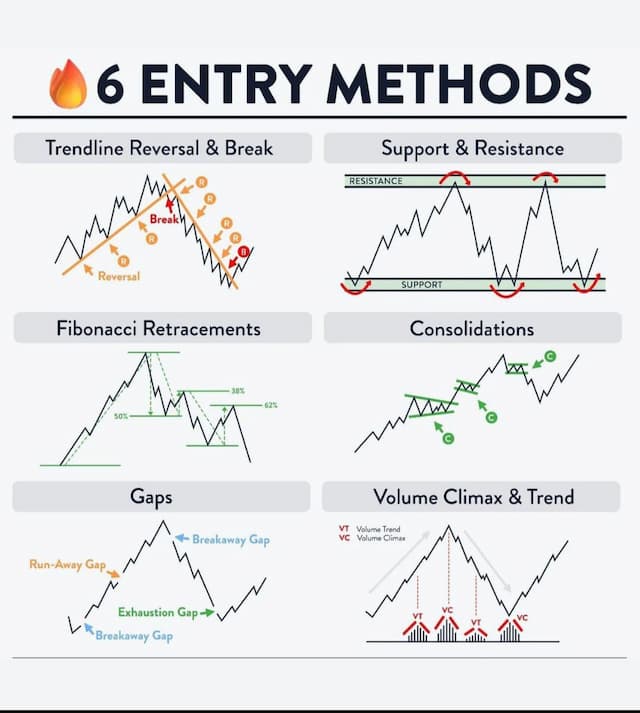

The Fibonacci retracement tool helps identify key levels where price may reverse or continue its trend. Common retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

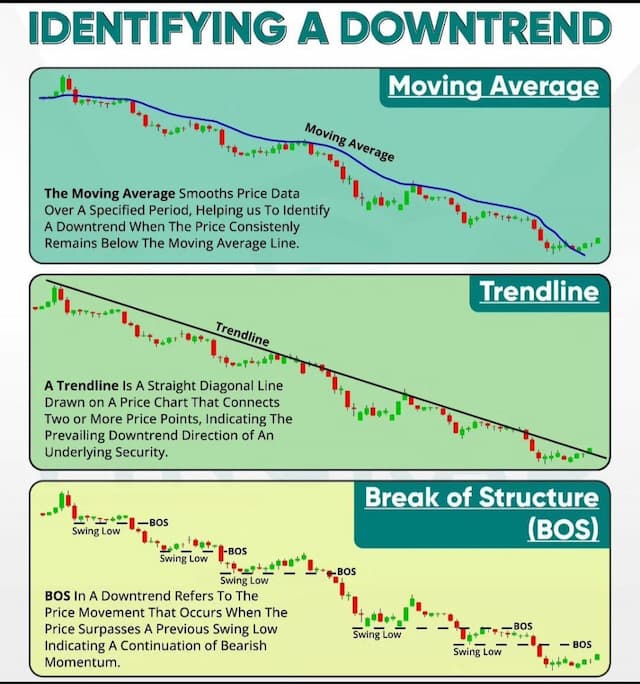

A downtrend is confirmed when lower highs and lower lows form consistently. Traders use trendlines, moving averages, and volume analysis to confirm a bearish market trend.

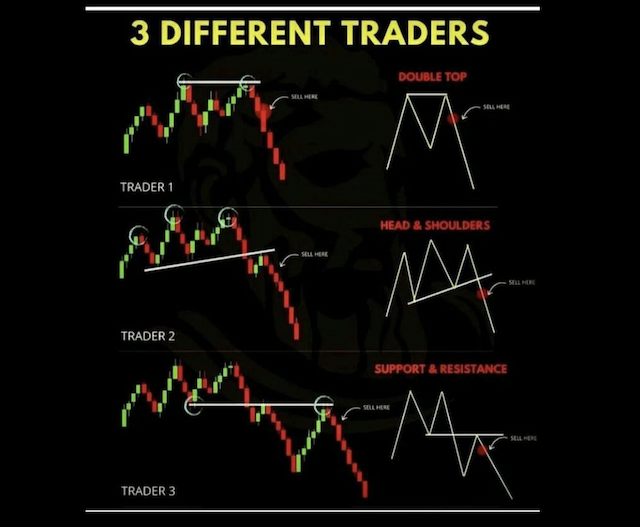

Scalpers – Trade for small profits in short timeframes. Swing Traders – Hold trades for days or weeks, capturing medium-term price movements. Position Traders – Invest long-term based on fundamental and technical analysis.

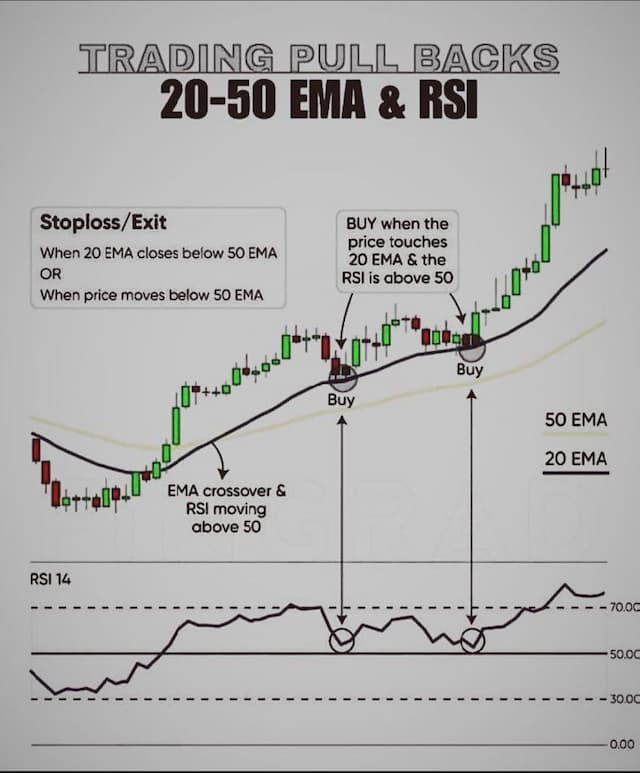

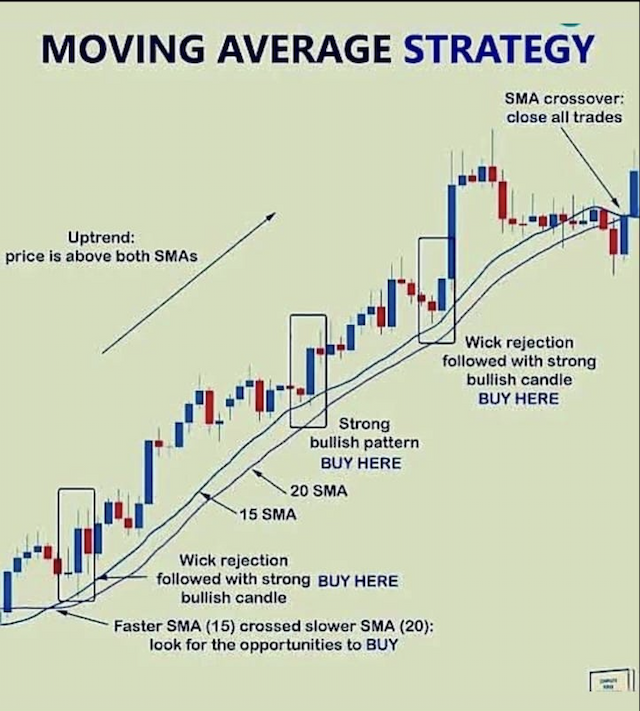

A Golden Cross occurs when a short-term moving average (e.g., 50-day) crosses above a long-term moving average (e.g., 200-day), signaling a bullish trend. The opposite is a Death Cross, indicating a bearish trend.

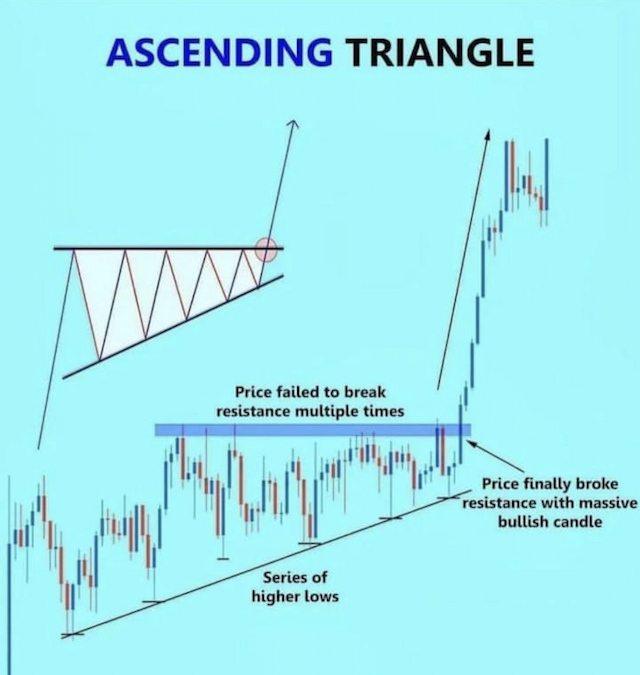

Traders use breakouts, retests, and bounces from trendlines to enter trades. Confirmation with volume and candlestick patterns improves accuracy.

A bullish chart pattern where price forms higher lows while hitting a horizontal resistance level. A breakout above resistance signals a potential uptrend continuation.

A pullback is a temporary retracement in an overall trend. Traders look for support/resistance levels, Fibonacci retracements, and moving averages to re-enter trades at better prices.

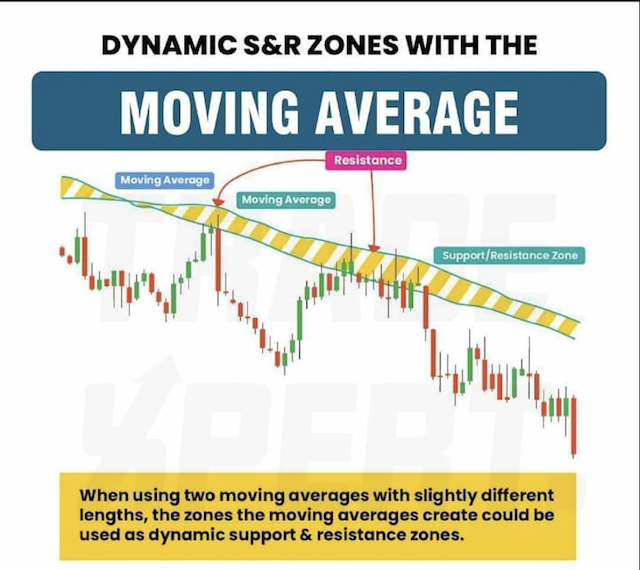

Moving averages (MA) smooth price action and identify trends. Common strategies include: MA Crossovers (e.g., 50 MA crossing 200 MA), Dynamic Support & Resistance (price bouncing off MAs), Trend Confirmation (price above MA = bullish, below MA = bearish).